In my How to Create a Budget Part 1 post, I showed you how to start a budget, which is simply to start by outlining what you currently spend (without changing your habits). If you’ve already done that, you should now have a total number indicating what you spent last month. From there, we can break down the different spending categories, and determine where you can cut back. One simple way to make a budget stretch further is to simply earn more, so that spending the same amount of money does not have the same negative effect on your finances. But you can also learn to cut back on expenses. For most people, learning to cut back is much more important because you could be outspending your income every month. I want you to be very honest with these numbers – the reason being is that if you are not honest now, it will only hurt your financial future. Budgets aren’t really fun to deal with, but if you don’t have unlimited finances, you will need to abide by your budget for financial safety!

It is also very important to compare your take home pay with the total you spent last month. Was the difference negative? If so, you definitely have an income or spending problem. If the difference was small but not significant, you still will want to look at where you could cut back and make changes to your budget. The difference between your expenses and your pay shows you how much money you have for savings or other incidental expenses. It is important to have money left over for saving, as well as unexpected expenses, or something fun each month. For example, if you earn $3,458 a month (after taxes), and you calculated your expenses at $3,294, that is only a net gain of $164 a month. That is nothing! You should have enough money to contribute to savings each month, and maybe an emergency fund (for things like vet bills or a new pair of breeches). If the difference between your income and expenses is that small, you need to take a serious look at what you can do to reduce your expenses, or find something to increase your income. Consider starting a side hustle so you can increase your income each month! But back to controlling your budget…

Housing (rent or mortgage) expenses can quickly bust your budget. Make sure that you are getting a decent deal and are not living outside your means. Most finance institutions suggest to spend 30% or less of your before tax income on housing. For example, if you make $3,000, you should be spending no more than $900 on rent or a mortgage. If you make $5,000 a month, you shouldn’t be spending more than $1,500. We live near Denver, and unfortunately, rent and housing prices are skyrocketing here! You may need a higher paying job just to pay higher rent! Here are some ways to reduce your housing expenses:

- Move to a cheaper area of the country. Unless you have a reason to stay in a certain place, the difference in rent could be huge for your budget and ability to pay your bills.

- Live with roommates. Even if you own your house, you can still have roommates that help (or even completely) pay the mortgage.

- Rent a room on AirBnb. Many people are renting rooms through Airbnb – just make sure you are prepared to have people stay with you, clean up after them, and have the proper insurance coverage for renting out part of your house.

- Move away from the city center. For example, we rented an apartment with 2 bedrooms, 1400 square feet, for $1,450 a month about 25 minutes from downtown Denver. In downtown Denver, a 2 bedroom, 945 square foot apartment is $2,090. That is a difference of $640 a month (and 455 square feet less space)! If you are working to pay off debt, moving away from the high prices of the city can result in extra money in your pocket. Being a bit further away can also remove a little of the temptation to go out all the time, thus saving you even more money.

- Reduce your living space. Do you own a huge 5 bedroom house, but you really only need two? Consider downsizing. Not only will your money usually go further for a smaller house, but you won’t need to maintain as much space.

Groceries – groceries can be pricey, especially if you are trying to eat healthy and are looking to purchase only fresh/real foods. My biggest suggestions on how to save on groceries are to plan your meals (use $5 meal plan or meal plan on your own), and to use cash back rebate apps – my favorite is Ibotta. I went from spending $100+ a week, to spending on average, around $60-70 per week. That is a savings of at least $120 per month, or $1,440 a year!!

Related post: How to Save Money at the Grocery Store

Other – most purchases that are classified as “other” may not be necessary. Coffee or happy hour with your friends is fun, but those purchases can add up surprisingly quickly. Instead, try to pick a cheaper option at the coffee shop (think plain coffee, not a specialty drink) or make coffee at home. And if you want to go to happy hour, bring cash and limit yourself to a set cash budget and one drink. One drink may make you appear “boring”, but you will save a lot of money. Alcoholic beverages are one of the main money makers for restaurants. Don’t let a fun evening with friends break your budget.

Shopping – Shopping purchases may be a necessity (like work clothing) or they are an unnecessary splurge (think “needing” a Coach purse instead of continuing to use the purse you already have). I find that shoes are a very important purchase, because being comfortable at work on my feet and exercising is very important for me. I also enjoy checking consignment and thrift stores for other clothing purchases. You can often find nice name brands for a fraction of the price if you are willing to look and wear something from a thrift store. If you are going to shop online, I highly suggest using Ebates – you get a percentage of your purchases back as a check every 3 months. I’ve been using Ebates for about 2 years now and love getting those “surprise” checks in the mail!

Horse Board – This may or may not be a possibility to reduce the cost of boarding. If you are willing to do a little work at the barn, your boarding facility may be willing to give you some cost off your normal board. Cleaning stalls, or helping with lessons, or holding horses for the farrier or vet are all ways that it may be possible to reduce your boarding cost or other boarders may pay you to do these things. Depending on what you pay for, it may also be worthwhile to obtain additional hay for your horse. I used to pay an extra $60 a month for an extra flake of hay for a lunch feeding. Once I priced this out, I realized I could buy hay, throw it in my car, and then feed my horse an extra 2 flakes of hay per day, for less money and just a little more work. Consider trying rough board. Rough board is where you do some or all of the work for your horse. You clean and feed, but pay significantly less. If you can find some friends at a barn like this, you can help each other out as well as the bonus of having someone else to keep an eye on your horse.

Insurance – Insurance is unfortunately a necessary evil. It costs money (sometimes a lot of money), but you may find that by comparing the cost between multiple carriers, that you can save a bit of money. For auto or home insurance, shop around and get quotes if your current policy goes up. Check with all of these insurance providers to see if any of them can save you money: Geico, State Farm, All State, Progressive, and Amica. Make sure to ask if you can get safe driver discounts, or discounts for lumping your home or renters insurance with your auto insurance. When we went to buy our house, we switched from the insurance plan we’d carried for the last 5 years, to a new carrier, and had the same coverage, for nearly $600 less per year!

Utilities – Rent is usually a fixed cost that you “choose” when you pick somewhere to live. But Utilities are somewhere that you can save money. For gas and electric, simply using less will cost less. Our house is freezing in the winter (just ask my mom…she thinks our house is way too cold), but we don’t pay a lot for our electric bill even when it is super cold outside. I’ve heard of people paying the same for an apartment as we now pay for our whole house that is only on electricity (no gas here which is probably part of the problem). Turning your thermostat down or up a few degrees (depending on the season) can save you hundreds of dollars a year.

For your internet and/or cable bill, it will cost something, but shopping around can reduce your cost significantly. Cable and internet providers tend to offer promotions, but then increase your cost after a certain amount of time. Call them to re-negotiate a new price, or choose another provider in your area that is offering a promotion. We recently chose to ditch satellite TV, and I haven’t even noticed it’s gone. That’s a decision that will save us at least $720 a year!

Gas/Car Expenses – Depending on your proximity to work, gas costs will be slightly concrete for traveling to and from work. There are a few ways to save on gas. First, go to Costco or a Kroger gas station which will save a little off each gallon. Next, if, and only if, you can pay off a credit card in full each month, you should find a card that gives you high rewards for gas and/or grocery purchases. I personally used the American Express Blue Cash Preferred. This card gets 6% back at grocery stores, and 3% at gas stations. I tend to use this card constantly for all grocery and gas purchases. It easily pays for it’s yearly fee and earns me extra cash back! Also, consider carpooling. If you live near someone who works where you do you can take turns driving. My husband and I commute together almost every day except if we have a reason we need to come or go at different times. It saves us a lot of gas money and car wear and tear!

When you’re buying a new/used car, be sure to consider what driving you plan to do with the car and the mpgs involved. Buying an older commuter car could be beneficial for saving money on gas and car payments. Be sure you shop around for auto loans before getting one. Interest rates can vary widely based on the company offering the loan. If you can get 0% financing, that is great – but usually only available on new cars. Don’t forget that a new car depreciates about 10-30% in the first year of ownership. Consider a car a few years or more older so that you can save money on depreciation, registration and insurance fees.

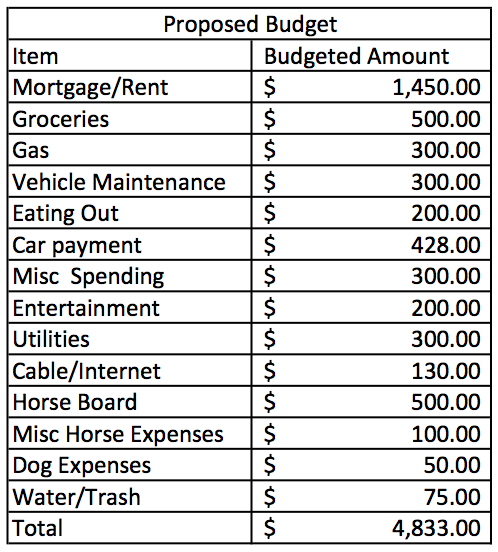

If you’re still reading this, you may be thinking, yeah that’s great that I could save money in those ways, but how do I actually put this into practice? Saying and doing are two very different things! I really love to see things written down – it helps me realize where I want to be, and where I currently am. So, at this point, I suggest outlining a new budget that you would like to stick to. It should look something like this: (This is a very generalized budget proposal to show you the different items that should be included. In theory, the amount spent would be less than your recorded amounts from adding up every expense the month before)

When writing up your new budget, it’s important to start with baby steps. If you typically have $500 of miscellaneous spending, try cutting out a few hundred dollars next month. And if your grocery budget is exploding, try to cut it back by $20 per week at first, and then keep trimming until you get it to where you want it to be. I talk a lot about meal planning because it really truly saves me hundreds of dollars a month.

There should also be a built in savings amount that you contribute to a savings account or retirement account every month, but we will talk more about that in a different post. If you don’t have any money left over to put toward savings, then your budget needs help ASAP!

By now you should have two dollar amounts (and maybe some spreadsheets flying around too), that tell you what you spent last month, and what you’re planning to spend this month. I suggest recording your spending again this month to see if you can stay on budget. I like to do it as I go because then I realize when I am already approaching spending too much in a category. Start implementing meal planning, and not going out to eat if you are trying to save money on groceries. Or don’t let yourself purchase anything you can think of on Amazon, but rather take 3 days and see if you still want it/need it.

How is this budgeting stuff working out for you? Are you better at sticking to the budget when it is written down? I know a lot of people will put their budget on their desk, or up on the fridge because then they see it every day and therefore it’s a constant reminder to stick with it.

Leave a Reply