Just a few years ago, my spending was a bit out of control. My husband traveled for work, and it made me feel better to buy things and go out to eat all the time. I would go to the grocery store every few days (sometimes every day), and we spent a lot of money. I didn’t think anything of it, but now I look back with a cringe. I sat down and got serious about making a budget and sticking to it. We wanted to buy a house (a horse property to be more specific), and when I looked at our current spending, I was a bit shocked.

Whether you’re saving up to buy something new (think horse trailer or a house), or you just want to put more money into your savings account, we can all benefit from being more budget conscious. I have a few savings goals I hope to reach within the next few years: Buying a truck and trailer, and completing some house projects. So I want to save as much money as I can. I don’t like thinking that I have frivolously spent money for no reason either – I want to maximize my dollars so I can save more for the future.

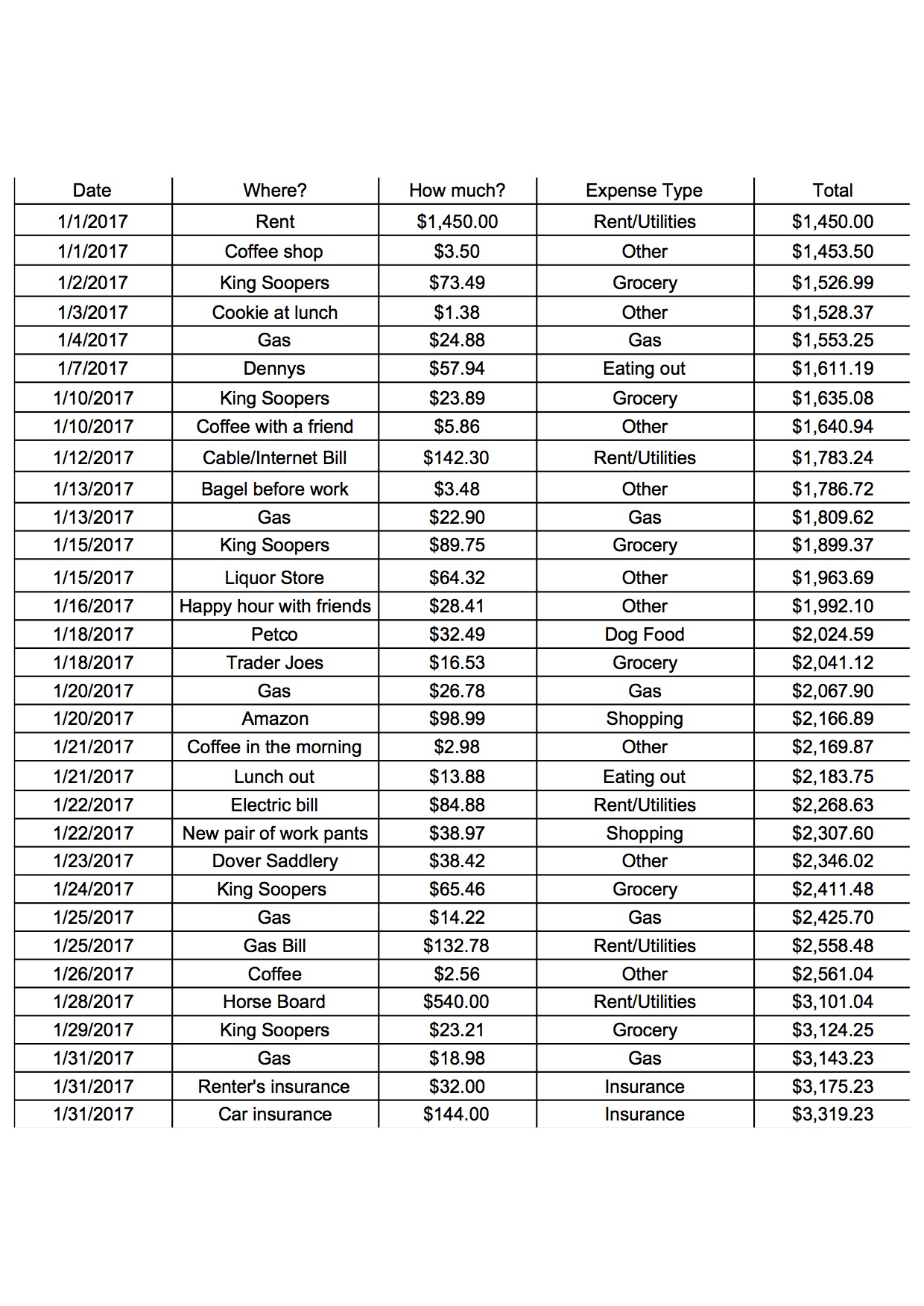

Budgeting isn’t really “fun” but I do enjoy finding new ways to save and earn money (check out my side hustle post here). The best way to start working on your budget is to examine what you are already spending. I did this by using a spreadsheet and put EVERYTHING in that spreadsheet. It is also important not to change your spending during the time you are tracking your purchases. If you buy a coffee and cookie, it goes in the spreadsheet. If you stop at the grocery store for one item, it goes on the spreadsheet. Something like the chart below. I cannot emphasize enough to put EVERYTHING on your spreadsheet!! This will give you a clear picture of what you already spend. From there you can determine ways to save and cut back so you can reach your goal budget. I also like to split my renter’s insurance, car insurance, horse insurance – basically anything that is a yearly or bi-yearly payment into 12, and put it on each month’s budget. Then you truly know how much you are spending per month.

* If you prefer pen and paper, you can easily do this in a notebook too. Make sure you write down all the things you buy in a month.

Once you have outlined all your spending for the month, and placed it in categories, one of the most important things is to look at the total (in the example above, that is $3,319.23). If you only make $2,900 a month, simple math will tell you that there is a problem there! Now if you are working off two incomes and your baseline income is closer to $5,000, then this much money spent in a month isn’t as worrisome. Make sure you are honest with yourself when comparing your income – Don’t say oh, well I do make $3,400 a month, when really you only take home $2,900 after taxes. Compare your after-tax take home income when comparing to your spending.

You also should take a look at how much you spend in each category as well. In the example above, here is the breakdown of expenses:

- Rent/Utilities $2,349.96 (you’ll notice I included my horse board in this category because I consider it a monthly living expense)

- Groceries $292.73

- Other $150.91

- Eating Out $71.82

- Insurance $176

- Shopping $38.97

- Gas $107.56

Don’t forget about car payments and student loans in your budget spreadsheet.

If you’ve made it to this point, you now have a spreadsheet or notebook list that shows your expenses in a month. Take an honest look at your income and determine how much of a difference you need to create with a new budget. If you need to cut out $200 in excess spending, consider earning an extra $200 (think side hustles), or reduce your spending by that $200. In the next post, I will show you some ways to save money in each category above. Small changes add up quickly to create change.

Leave a Reply